How to pick a credit card that will work for you

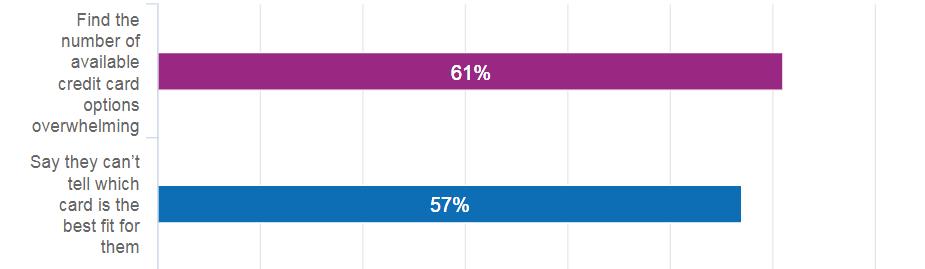

Do you have difficulty determining which credit card is going to suit you best? Well you’re not alone. In fact a recent survey has indicated that 61% of searching customers find the number of available choices overwhelming, and 57% indicate that they can’t determine what the best fit is for them. With more Credit Card options out there than Instagram has filters, how can you be so sure you’ve picked the right one for yourself? We’re about to help you through this.

Rewards & Perk Cards

First question, do you pay off your balance at the end of every month? If so, then these types of cards can be of great benefit to you. Typically, rewards and perk cards have a set annual fee and come with higher interest rates than their no-fee, low interest counterparts. In exchange for this however, they provide you with a variety of cardholder benefits such as improved warranty protection, additional reward points earned at specific locations, auto rental insurance, travel insurance, and much more. Some of the elite rewards cards even offer concierge service to assist their cardholders with administrative tasks such as travel & party planning, dinner reservations, hotel bookings, and more. The most important point to consider when seeking a rewards card is if you intend to keep a balance on your card. If so, you will end up paying higher interest rates than you would on other options. Your best bet here is to pay your balance each month if possible and benefit from the perks, while avoiding the higher costs potentially associated with them.

Cashback Cards

Cashback cards are gaining huge momentum in the credit card industry. Ranging from immediate 0.5% to 2.0% cashback on ALL your purchases made with the card, it’s easy to see why these types of cards are becoming hugely popular. If you’re the type of person who doesn’t care much for the extra perks and rewards of your card, or won’t make much use out of them then consider what the cashback cards have to offer. Typically, these cards also offer higher interest rates, so it’s not recommended for those who tend to carry a large balance since the cashback percentage will be quickly eaten up by the extra interest you will pay vs a low rate card. These types of cards can also be rewards and perk cards as well, but keep in mind you’ll likely pay an annual fee to take advantage of these benefits.

Low Interest & Balance Transfer Cards

Almost all providers have a line of low interest or Flex-rate cards that will give you a lower rate depending on your credit score. These types of cards typically come with little to no additional perks or benefits outside of reward points and standard provider services. These are the best cards however for those that tend to run a higher balance on their cards. In fact, by switching to a low interest card cardholders can save over 50% on their interest payments each month. For someone who holds a $5,000 to $10,000 balance, that’s potentially $40 to $80+ each month that could be saved that’s going directly to unnecessary interest payments. Some providers will also offer promotional incentives as well for balance transfers that will grant their cardholders a limited time offer of exceptionally low interest rates for a set period of time.

Travel Cards

Another type of benefit card that is popular among cardholders is the Travel Reward Card. These types of cards typically allow the user to accumulate points through their purchases and redeem at a later date towards flights, hotels, cruises, etc. These types of cards usually involve an annual fee on the higher side, and can vary in terms of interest rates. Some travel cards do come with extra benefits above and beyond traditional benefit perk cards such as emergency health insurance, or trip cancellation and interruption insurance, lost baggage insurance, and so on. This type of card is going to suit a cardholder that uses it while travelling to really make use of the benefits offered by the provider.

Sign up for our Newsletters!