1. Your maximum contribution amount

Money going in to an RSP account is tax deductible in the year it is deposited so this can be a great strategy to save money on your income tax bill. To prevent too many dollars taken out of the tax base, the government puts limits on how much we can contribute each year. This year you can deposit anywhere from 0 to 18% of your annual earnings to a maximum of $26,010. Keep in mind money withdrawn is also taxable in the year it is received, so be sure to only deposit what you plan to leave in to retirement to take maximum advantage of this program.

2. Yearly limits carry forward year over year

The yearly maximum deposit of 18% of earnings has existed for many years. This allowable amount accumulates each year and can grow to a considerable sum over the years. To find out your limit today, check on the Service Canada website or look at your most recent Notice of Assessment (mailed to you from Revenue Canada when they confirm income tax amounts each year). There is a bonus, the Service Canada website will also tell you about your CPP contributions made and project pension earnings at retirement.

3. RRSP contribution = tax refund

An RRSP is used as a tax shelter from income tax. Every deposit made can be deducted from your earned income and reduce the tax payable. If your employer already deducted as they paid you, you can receive a refund at tax time. The more you make, the higher you pay and the more you can save.

4. The early you start the easier it is

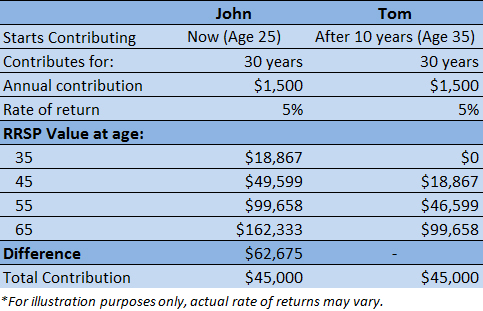

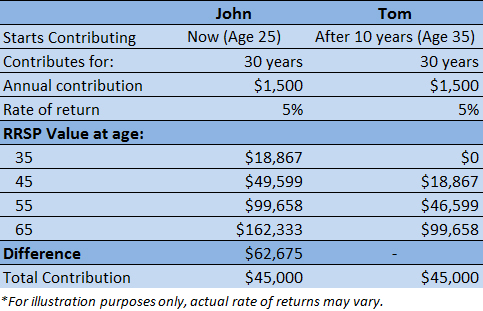

While RRSP’s benefit those in the higher income tax brackets, it’s better to take advantage of them earlier rather than later to take advantage of compound interest. To illustrate this point see below:

Notice that the contribution amounts are the same, but John has managed to accumulate an additional $62,675 in compound interest over the 40 year period. The amount that each person puts into their RRSP each year will vary, but this demonstrates the value of starting your investment early. Even if you are investing in small amounts, they will grow over the entire period of your RRSP. To further this example, if you invested only $1,000 and never made any further contributions, at a 5% rate of return that amount would grow to $7,358 over the 40 year period.

These examples are only illustrations of the investing power of compound interest, the actual results may vary.

5. Set-up automatic transfers to save for you

Remembering to put money aside or into your RRSP every month is not all that time consuming by itself, however it can be made much easier by simply automating the process. Set an automatic transfer with your financial institution to transfer the amount you wish to set aside each month or paycheck and transfer it into a separate account that you can use to make your annual contribution at year end. Depending on the type of RRSP account you hold, you may even be able to have the money automatically deposited into your RRSP account, saving you a step at the end of the year and further taking advantage of compound interest.

6. RRSP’s aren’t limited to savings accounts

Not all RRSP’s are created equal, in terms of risk and return that is. There are several different types of investments that can be held in an RRSP, the most popular being mutual funds among Canadians. Some of the other types of investments that can be held in an RRSP are:

- Guaranteed Investment Certificates (GICs and sometimes also called Term Deposits)

- Bonds

- Exchange Traded Funds (ETFs)

- Stocks

- Segregated Funds

- Mortgage Loans within certain conditions and more

It is important to keep in mind that you can mix and match these investments in your RRSP Portfolio you aren’t limited to picking just one. Which investment type is right for you? That’s a discussion best saved for your Financial Advisor as each type of investment will carry a different associated risk or benefit.

7. Your investments grow tax free

Probably one of the largest benefits of holding an RRSP is that your investments grow inside the portfolio completely tax free. This means you don’t pay taxes for capital gains, dividends or interest on the money earned off of the investment unlike non-registered investments. You will however still pay your current tax rate on the money when you take it out as discussed in section 3.

8. Can I take my money out of my RRSP’s without penalty?

There is two ways to withdraw money without penalty. One is with the Home Buyer’s Plan, allowing you to withdraw up to $25,000 from your RRSPs without paying tax. The stipulation here is it is just a loan from your RRSP and, you still need to pay it back in full within 15 years or you will incur penalties. Another option is to withdraw towards your education, called the Lifelong Learning plan where you can withdraw up to $10,000 each year – this also has to be paid back or there are penalties. Note that withdrawals must be made more than 90 days after deposits. Be tax smart and check with your financial advisor for your best options.

Sign up for our Newsletters!