PROMO ENDED ON MARCH 1, 2021

Making an RRSP contribution helps you save on taxes – you may even get a tax refund. But what happens if you don’t have enough money to make a contribution? Should you borrow through an RRSP loan? Read below to learn more.

How can an RRSP Catch Up Loan help me?

Putting away money for your RRSP can be difficult, especially if you’re dealing with bills, credit card debt, and other life commitments that don’t allow you the time or money to focus on your retirement goals. If you fear you will not be able to contribute to your RRSP this coming year, then the RRSP Catch Up loan is the option for you. It allows you to borrow money at low rates in order to keep contributing to your RRSP.*

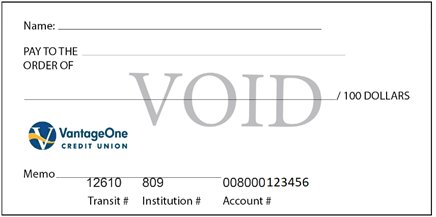

What are the benefits of a VantageOne RRSP Catch Up Loan?

Using an RRSP loan can be a powerful strategy to boost your RRSP contributions and build your retirement portfolio. The RRSP Catch Up Loan allows you to fill up this contribution room while reaping the rewards of the tax benefits. Plus, with VantageOne you get these extra benefits:

- •local approvals

- •competitive rates – check out our special offer below!

- •weekly, bi-weekly or monthly repayment terms

- •& more!

Current Rates*

- • 1 year term loan insured – 2.25%*

- • 1 year term loan uninsured – 2.45%*

*Rates are subject to change at any time without notice. Limited time offer.

Minimum $500 deposit. Terms and conditions apply, please ask us for further details.

Talk to one of our local experts to discuss all things retirement and how we can help you reach your goals! Contact us Contact Us