The cold winter months combined with our homeless population have been a challenging part of our society and has proved to be a challenge for VantageOne. This year, we have seen an increased use of our ATM rooms for shelter. Out of concern for our members’ safety and damage to the equipment and facilities, the difficult decision was made to lock many of the walk-up ATM rooms after hours and on weekends, leaving only the drive-thru ATMs available. We sincerely apologize for any inconvenience this may have caused.

With warmer weather arriving, we have decided to return the Main Branch walk up ATM to 24/7 access for our members. Please see below for an updated ATM schedule:

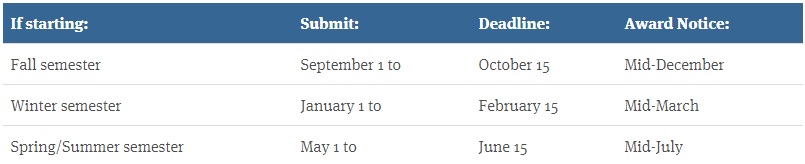

Main Branch:

Walk Up – Open 24 Hours

Armstrong Branch:

Open 24 Hours – 7 days a week

Okanagan Landing Branch:

Walk Up – Open 8:00am to 5:00pm Monday to Friday – Closed Saturday & Sunday

Drive Thru – 24 Hours

North Vernon Branch:

Walk Up – Open 8:00am to 5:00pm Tuesday to Friday (Saturday 8:00am to 3:00pm) Closed Sunday & Monday

Drive Thru – 24 Hours

Peachland Branch:

Walk Up – Tuesday to Saturday 8:00am to 9:00pm – Closed Sunday & Monday

Drive Thru – Currently closed

Our long-term plan is to ensure we have an outdoor accessible ATM at all of our locations to serve our members 24/7. VantageOne will continue to work closely with our communities and community partners tofind ways to address homelessness.