For a current listing of scams, please visit the Canadian Anti-Fraud Centre.

For tips and resources, visit the VantageOne Anti-Fraud page here.

——– June 5, 2025 ——–

The Canadian Anti-Fraud Centre (CAFC) is warning the public about fraudsters impersonating the CAFC. Fraudsters are using CAFC employee names, spoofing the CAFC’s phone number and email addresses to mislead victims while promising to assist with investigations and/or recover lost funds.

Click here to learn about common scam variations where fraudsters claim to be from the CAFC:

——– March 1, 2025 ——–

Did you know that March is Fraud Awareness and Prevention Month?

Fraud is an ever-present threat in today’s digital age, but with the right knowledge and precautions, you can protect yourself and others. This Fraud Awareness Month, take the time to review the different types of scams that exist and educate yourself about how to spot and avoid them. Remember, the best defence against fraud is awareness—stay vigilant and stay safe!

Stay Safe, Stay Informed. Learn more here.

——– February 12, 2025 ——–

Residents across the Central Okanagan are being asked to speak with their elderly family members and friends about the risk of an ongoing “grandparent scam” that is circulating.

According to the RCMP, several people in Kelowna and West Kelowna have fallen victim to scammers who have collected over $20,000 in cash. The scammers collected the money from people who thought they were helping their grandchildren, police said in a news release.

“Police said that the scammer impersonates the grandchild or as a lawyer on their behalf. The scammer then asks for money to secure the grandchild’s bail following an alleged arrest. Once the victim has withdrawn the money, the scammers arrange a pick up location or even arrive at the victim’s house. In most of the cases reported to the RCMP, a woman wearing a face covering arrives, takes the money and leaves on foot.”

Learn more here

——– January 23, 2025 ——–

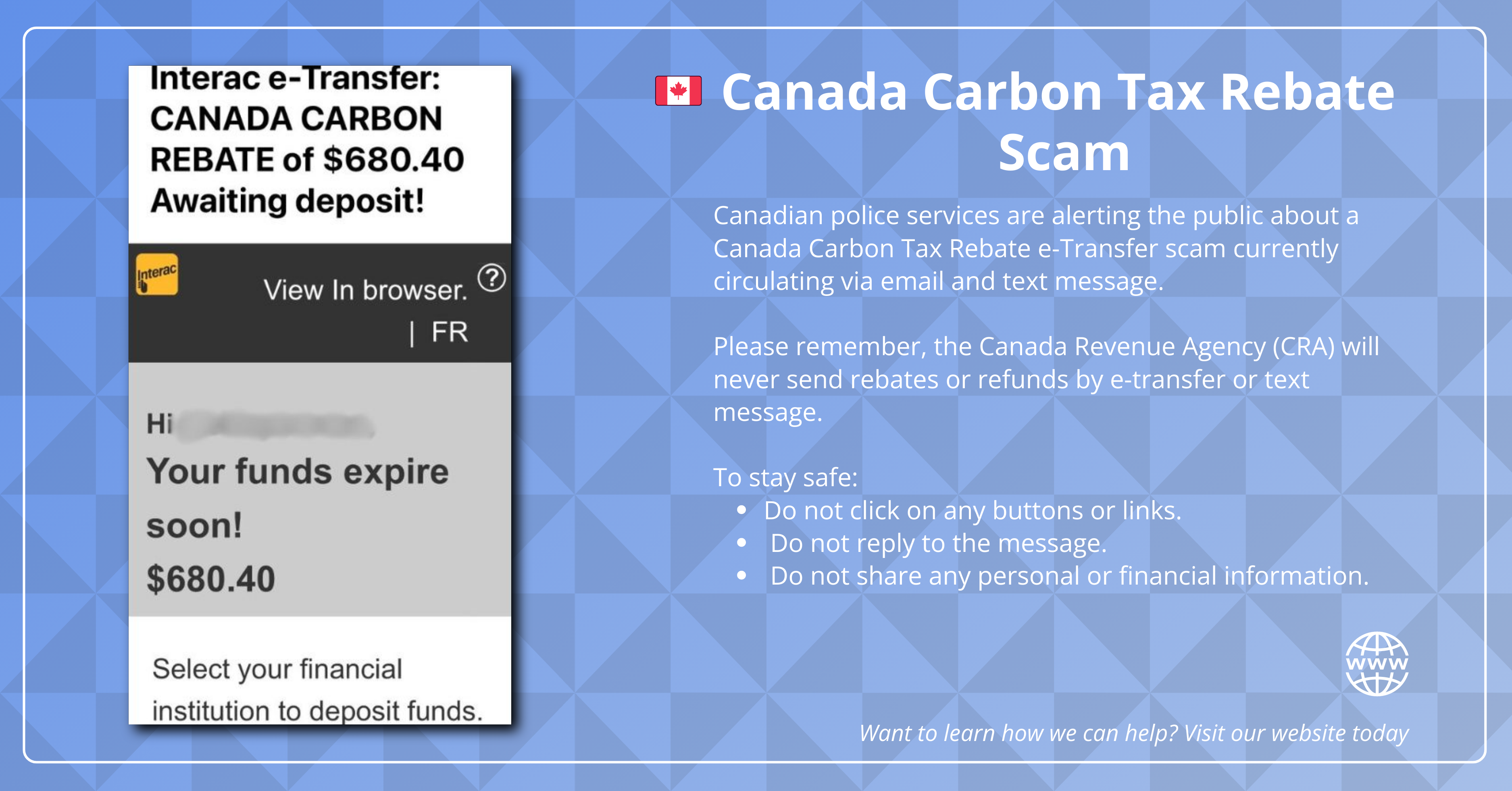

Canadian police services are alerting the public about a Canada Carbon Tax Rebate e-Transfer scam currently circulating via email and text message. This scam may involve look-alike domains and phishing websites designed to deceive recipients.

Please note that this scam is likely to resurface periodically, particularly around the distribution dates for the Canada Carbon Tax Rebate which are:

- January 15

- April 15

- July 15

- October 15

Below are examples of fraudulent email/text messages you may receive.

——- December 10, 2024 ——–

Canada Post Scam Alert

——- October 21, 2024 ——–

Local Online Marketplace Scam

Local police have issued a warning to the public following several people in the Okanagan falling victim to a scam that originates from local online marketplace buy and sell sites.

How does the scam work?

- You as the seller, post an item for sale online.

- You are contacted by “the buyer” offering to pay you full price for the item you are selling.

- “The buyer” claims they will e-transfer the funds to you, asking you to check your email for the notification.

- In the email, there is a link that once clicked, takes you to a “legitimate-looking” banking webpage.

- The seller is then asked to enter their banking information along with their phone number to receive a verification code through a text message

- Once that information is entered, scammers then have direct access to your bank account and can transfer funds out.

How can you avoid this scam?

Police recommend that the sale of online marketplace items be done in a public place with cameras.

If you have fallen victim to a scam, please reach out to your local RCMP detachment Vernon North Okanagan detachment – British Columbia (rcmp-grc.gc.ca)

Protect yourself from fraud, learn more here.